All Categories

Featured

[/image][=video]

[/video]

Allow's say you have a hundred thousand bucks in a bank, and then you locate it an investment, a submission or something that you're desiring to place a hundred thousand into. Now it's gone from the financial institution and it's in the syndication. It's either in the bank or the submission, one of the two, yet it's not in both.

And I attempt to aid people recognize, you recognize, exactly how to raise that effectiveness of their, their money so that they can do even more with it. And I'm truly going to attempt to make this simple of utilizing a possession to purchase an additional property.

Genuine estate investors do this regularly, where you would build up equity in an actual estate or a residential property that you own, any type of, any type of property. And after that you would take an equity placement versus that and utilize it to purchase another building. You know, that that's not an a foreign principle in all, correct? Entirely.

And after that utilizing that actual estate to buy more property is that after that you become very revealed to real estate, indicating that it's all associated. All of those assets become associated. In a downturn, in the totality of the actual estate market, after that when those, you know, things begin to shed worth, which does occur.

Uh, you understand, and so you don't want to have all of your properties correlated. What this does is it offers you an area to put cash at first that is completely uncorrelated to the actual estate market that is going to be there guaranteed and be ensured to boost in value over time that you can still have a really high collateralization variable or like a hundred percent collateralization of the cash money value inside of these policies.

Bank On Yourself Concept

I'm attempting to make that as basic as possible. Does that make good sense to you Marco? Yes, specifically. Precisely. That is, that is specifically the vital point is that you're expanding a possession that is ensured to expand, yet you have the ability to obtain against it, to place right into an additional asset.

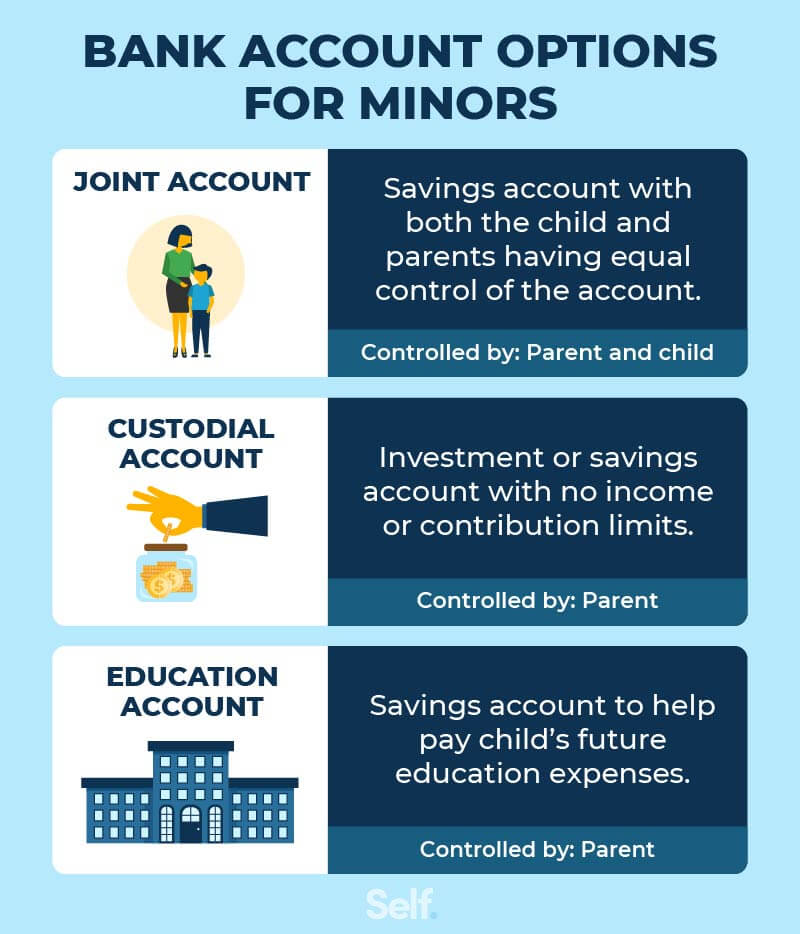

If they had a residence worth a million bucks, that they had actually $500,000 paid off on, they could most likely get a $300,000 home equity line of credit scores due to the fact that they normally would obtain an 80 20 car loan to value on that. And they could get a $300,000 home equity line of debt.

How Do I Start Infinite Banking

For one thing, that credit scores line is fixed. In various other words, it's going to stay at $300,000, no issue exactly how long it goes, it's going to remain at 300,000, unless you go get a new appraisal and you obtain requalified economically, and you increase your credit scores line, which is a huge pain to do every time you place in money, which is usually when a year, you add brand-new capital to one of these specifically developed bulletproof wide range policies that I create for individuals, your internal line of debt or your accessibility to funding goes up every year.

Latest Posts

Tbt: How To Be Your Own Bank, Multiply Your Money, And ...

Create Your Own Banking System

Byob: How To Be Your Own Bank